From eBay to eBlah: How the Auction Giant Lost Its Crown

If you’ve been around the internet since the late ’90s, you probably remember the thrill of eBay’s golden age. It was the digital Wild West of online auctions — a place where anyone could list anything and potentially strike gold. Initially, most sellers posted many items for as low as $0.99 (…or less). EBay became known for the constant thrill of sellers letting their item get bid-up or bidders finding a rare bargain. For buyers and sellers, eBay was magical. But over the past three decades, that magic has steadily eroded as the auction has transformed into an online price list. We are left with a platform that no longer seems to understand what made it great in the first place.

A Rocket Ship Launch

The company started humbly in 1995, initially starting with free auctions, but gradually transitioned into the model that served it so well from 1996 until 2008 with an initial start price and a final value fee. In the companies first revenue generating year of 1996 — eBay generated just $372,000 in revenue — eBay's growth was staggering. By 2001, it had topped $748 million. Three years later, it hit $3.27 billion. By 2008, revenue reached $8.54 billion annually.

These numbers reflected a revolution in how people sold things. You could auction off a rare collectible or a broken toaster with equal confidence. It was a global garage sale driven by trust, community feedback, and the thrill of competition.

But something changed in 2008 — and not just the global economy.

The End of the Whitman Era — and the Seller Backlash

Meg Whitman, who had led eBay since 1998, stepped down in January 2008. Under her watch, eBay had grown from a startup to an internet titan. Her successor, John Donahoe, former Bain & Company alum1, had a very different vision. 2

Almost immediately, Donahoe made sweeping changes that infuriated longtime sellers. Chief among them: eliminating sellers’ ability to leave neutral or negative feedback for buyers.3 Reputation was everything on eBay, and this change upended the trust dynamic.

At the same time, fees were rising — dramatically. The lowest-tier Final Value Fee (FVF), which had been 5.25%, jumped to 8.75% for the first $25 of every sale. Sellers felt betrayed. Message boards exploded. Some called for boycotts.

And while many sellers stayed — because eBay still had the eyeballs — the relationship had changed. For the first time, many began to feel like eBay's true customer wasn’t the seller or the buyer, but Wall Street.

Donahoe’s Vision: Modernization and Margin

To his credit, Donahoe wasn’t just raising fees to pad the bottom line. In 2009, he announced a three-year roadmap for growth aimed at modernizing the platform, making it more buyer-friendly, and expanding during the financial crisis.

In the short term, it worked. Revenue held steady. And when the economy recovered, eBay surged again — peaking at $14.07 billion in 2012.

But beneath that momentum grew a structural problem.

The PayPal Dilemma and the 2015 Split

As eBay’s core marketplace matured, PayPal exploded. In 2009, PayPal’s revenue dwarfed the eBay marketplace revenue with PayPal generating only half of the revenue of the eBay Marketplace. By 2014, PayPal caught up nearly matching the eBay Marketplace revenue.

Enter activist investor Carl Icahn, who began acquiring shares in late 2013. Icahn, the legendary activist investor, has a reputation for being—let’s just say—a bit aggressive. The board resisted — until it couldn’t. In 2014, Icahn acquired enough eBay shares to place two members on the board and push for major changes, including a PayPal spinoff.

In 2015, eBay and PayPal officially separated. Donahoe stepped down. Devin Wenig took over. And that’s when the real stagnation began. Without PayPal to pad the growth of the company, the Marketplace segment went into decline, immediately loosing $200 million in revenue the following year.

From 2014 to 2024, eBay marketplace revenue inched from annual revenues of $8.79 billion to just $10.28 billion. That’s a decade of near-flatline — especially disappointing when compared to 2001–2011, when revenue grew over 1,000%.

eBay Fee Evolution: 1996 to Today

Initial Pricing (1996)

In the early days, eBay's fee system was simple and progressive—designed to support auctions and small sellers: 4

Insertion Fees:

Up to $9.99: 25¢

$10–$24.99: 50¢

$25–$49.99: $1.00

$50 or more: $2.00

Final Value Fees (FVF):

5.0% on the first $25

2.5% on the next $975

1.0% on any amount over $1,000

This fee structure rewarded high-value sellers and gave auctioneers a low-risk way to list items cheaply.

2002: First Major Increase

By 2002, eBay had already started raising fees modestly: 5

Insertion Fees:

Up to $9.99: 30¢

$10–$24.99: 55¢

$25–$49.99: $1.10

$50–$199.99: $2.20

$200+: $3.30

Final Value Fees (FVF):

5.25% on the first $25

2.75% on the next $975

1.5% on any amount over $1,000

The structure was still tiered and reasonable—but rising.

2008: Seller Revolt and Restructuring

This was the year that sparked major backlash, with dramatic fee changes and new store-based pricing:

Insertion Fees (variable by store level):

Most sellers moved to online stores that included a set number of items each month 6

$24.95 Basic Store — 250 fixed price and 250 auction

$74.95 Premium Store — 1,000 fixed price and 500 auction

$349.95 Anchor Store — 10,000 fixed price and 1,000 auction

Lower costs up front were framed as a win, but…

Final Value Fees (FVF):

Items under $25: 8.75%

Items over $25 retained the 2002 tiered structure

While insertion fees appeared to drop, many sellers paid more overall—especially on lower-value items—because FVF hikes outweighed listing savings.

2015: Free Listings for Everyone! …and a massive increase in Final Value Fees

By May 1, 2015, eBay introduces a policy to make everyone a seller with their new pricing structure and eliminates tiered FVF pricing: 7

Insertion Fees:

40 Free auction / fixed price listings plus 30¢ for sellers with no store

150 fixed price listings plus 25¢ auction and 20¢ fixed price for Basic Stores

500 fixed price listings plus 15¢ auction and 10¢ fixed price for Premium Stores

2,500 fixed price listings plus 10¢ auction and 5¢ fixed price for Anchor Stores

Final Value Fees (FVF):

10% with a maximum fee of $750 without a store

9% with a maximum fee of $250 for Collectibles with a store

The structure was still reasonable—but rising.

2016: Store Prices Jump Dramatically

By Spring of 2016, eBay increases their store prices, but add auction listings to store subscriptions: 8

$24.95 (or $19.95 with yearly subscription) for a Basic Store, but number of listings are increased to 250 auction and 250 fixed price

$74.95 (or $59.95 with yearly subscription) for a Premium Store, but number of listings are increased to 500 auction and 1,000 fixed price

$349.95 (or $299.95 with yearly subscription) for a Basic Store, but number of listings are increased to 1,000 auction and 10,000 fixed price

Today: The Flat-Rate Fee Era

Over time, eBay’s fee system is more streamlined—but also more aggressive with final value fee’s creeping up to todays much higher rates:

Insertion Fees:

$0.00 for first 250 listings/month (non-store accounts)

Stores mostly followed the 2016 model, except with higher prices

Final Value Fees (FVF):

Flat 13.25%

Applies to item price + shipping + tax

Additional $0.30 per order processing fee

Shipping is now included in the FVF calculation

This pricing structure penalizes high-value sales and squeezes low-margin sellers. While upfront listings are "free," eBay recoups much more aggressively on the backend.

While insertion fees dropped or disappeared for many casual sellers, Final Value Fees became far more aggressive — especially with the inclusion of shipping and tax in the fee base. A fee that used to apply only to the sale price now touches nearly every dollar in the transaction.

It’s nearly a 300% increase over two decades — even before you factor in the new marketing programs or costs of returns.

Fixed-Price Listings: Death of the Auction

eBay’s most radical shift was cultural. Once a home for 99¢ auctions, it morphed into a catalog-style marketplace. "Fixed Priced" listings became the norm. Auctions became the exception.

At the same time, eBay began offering 250 free listings a month. Sounds good, right? Unfortunately, it had a dark side.

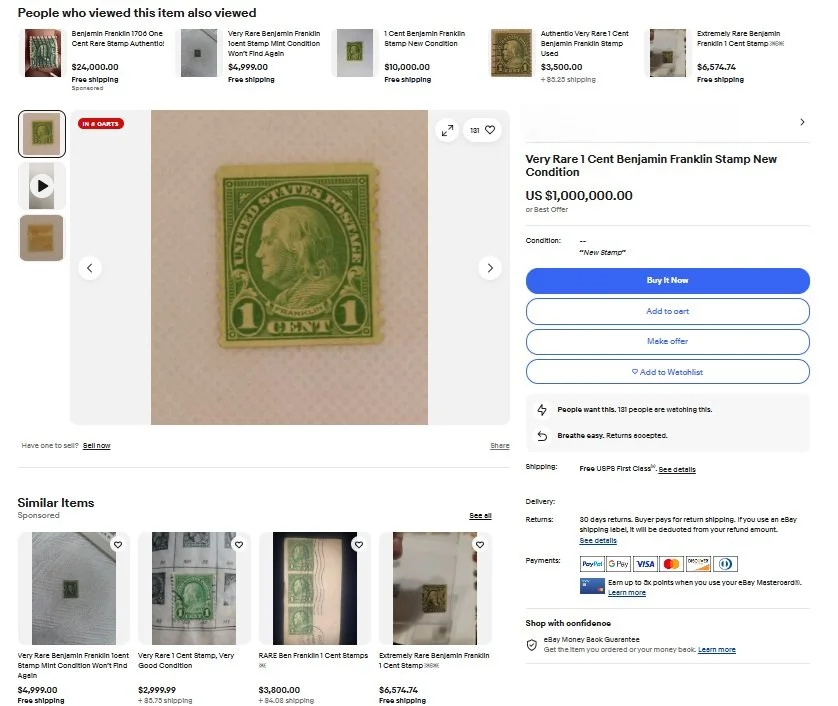

With no financial disincentive to over-list, the site was soon flooded with common material relisted endlessly, often listed by amateur collectors or garage sale addicts who really didn’t know stamps, who flooded the site with million dollar “Very Rare 1¢ Franklin” listings. The stamp category, in particular, became a minefield of worthless garbage, clickbait titles, and novice sellers misrepresenting ordinary items as rare treasures.

Another dreamer hoping their 597 coil will win the $1 million stamp jackpot. Usernames have been removed to protect the cluelessly naive.

What used to feel like a treasure hunt now feels like digging through a landfill.

The Collector’s Perspective: A Shrinking Marketplace

For niche hobbyists — stamp collectors included — the changes have been particularly painful. The rise in fees, the disappearance of auctions, and the flood of misleading listings make eBay a tough place to do business.

A beginner trying to value a stamp collection sees pages of overpriced nonsense. And veteran collectors? Many have moved on with many finding a new home at Hipstamp.

Once a vital hub for philately, eBay is now "the place you sell when you have no better option."

Final Thoughts: What Could Have Been

eBay was once the most exciting marketplace on the internet — a chaotic, vibrant, and trustworthy digital flea market. It was a place where you could find the weird, the rare, the nostalgic — and where pricing was driven by supply, demand, and human curiosity.

But starting in 2008, a series of leadership changes, rising fees, algorithmic tweaks, and the loss of PayPal chipped away at the foundation.

Today’s eBay still processes billions — but it lacks soul. And without serious changes, its next decade might look like the last one: flat, forgettable, and full of regret.

Because if there’s one thing eBay taught us, it’s this: once you lose momentum, it's hard to get it back.

https://en.wikipedia.org/wiki/John_Donahoe

https://investors.ebayinc.com/investor-news/press-release-details/2009/EBay-Inc-Announces-Three-Year-Roadmap-for-Growth/default.aspx

https://archive.nytimes.com/bits.blogs.nytimes.com/2008/01/29/sellers-give-negative-feedback-on-ebay-changes/#:~:text=Up%2Dfront%20listing%20fees%20for,Back%20to%20Craigslist%20I%20think.

https://www.annualreports.com/HostedData/AnnualReportArchive/e/NASDAQ_EBAY_2000.pdf

https://www.annualreports.com/HostedData/AnnualReportArchive/e/NASDAQ_EBAY_2000.pdf

https://pages.ebay.com/sellerinformation/news/sprupd16/features-fees.html#:~:text=Beginning%20May%201st%2C%20eBay%20Store,Expand

https://pages.ebay.com/sellerinformation/news/springupdate2015/rate-plans.html

https://pages.ebay.com/sellerinformation/news/sprupd16/features-fees.html#:~:text=Beginning%20May%201st%2C%20eBay%20Store,Expand